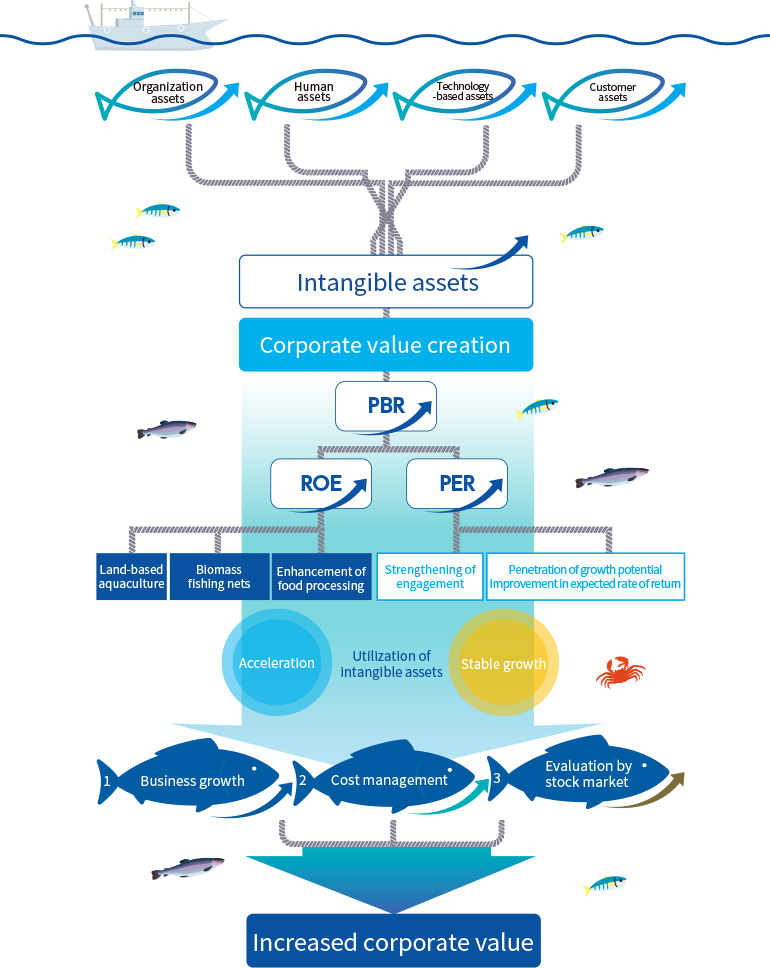

Toward Further Increasing Corporate Value

To achieve our ideal state in 10 years

Our strength lies in our technology and know-how for the fishing and marine products industries that we have cultivated while continuously supporting the marine products industry over the 115 years since our founding. Looking ahead to the future, we expect paradigm shifts to accelerate further, including changes in the marine environment and the depletion of resources. By leveraging the technology and services we have gained through many years of experience with our original business platform, we will steadily take on new challenges no matter the era. We believe that taking on this challenge will lead to increased corporate value.

1Business growth

Strengthen aquaculture engineering (land-based and marine)

- Total support for sustainable marine protein production through provision of farming know-how and materials

- Building a next-generation marine products industry (new aquaculture and fishing) that adapts to environmental changes

High profitability through high-value-added engineering services

Expand sales of environmentally friendly materials

- Providing environmentally friendly materials, including biodegradable fishing nets, that promote the sustainability of marine resources

- Providing total support for the symbiosis of fishing and other industries (materials provision + consulting)

From research and development and practical application to full-scale profitability

Enhance profitability with high-value-added processed marine products

- Large-scale investments in labor and power savings and production efficiency increase, including the introduction of the latest manufacturing lines at two major manufacturing subsidiaries in Mombetsu City, Hokkaido, were completed in the previous fiscal year

Provide original safe, secure, high-quality, high-value-added processed marine products

2Cost management

Awareness of improving cost of capital

Pursue the optimal capital structure to improve capital efficiency

Characteristics of the Company’s cash flow

Food Business

The fishing season for marine products is mainly from the early spring to early autumn, and purchases are made in advance. Funds recovered by sales through to year-end

Marine Business, Machinery Business and Materials Business

Relatively short period from purchase to funds recovery

We are advancing cash flow management, including reduction of recovery periods and inventories in each business, with the aim of keeping the D/E ratio within 1.0.

We also seek to enhance ROE and ROIC with capital efficiency in mind, in light of strengthening the financial position of the Company.

3Evaluation by stock market

Utilizing stock market indicators

Latest PBR = ROE × PER

Return on equity (ROE) was 9.1% (FY2024), and the share price was 1,959.6 yen (average closing price from January–March 2025). The price earnings ratio (PER) for FY2024, therefore, was 6.12 times, and the price-to-book ratio (PBR) was 0.54 times, indicating that improvement is still in progress.

Increase in ROE × improvement of PER → Increase in PBR

* We aim to increase PBR and achieve an increase in enterprise value exceeding dissolution value (PBR=1)

Improvement of PER

Promote understanding of the Company’s revenue structure (business model) to enhance recognition of the Company’s sustainable creation and expansion of profit in the market.

Improve expected profit margin through promotion of growth strategies such as the medium-term management plan

Increase in ROE

Improve investment efficiency and profitability by promoting efficient management