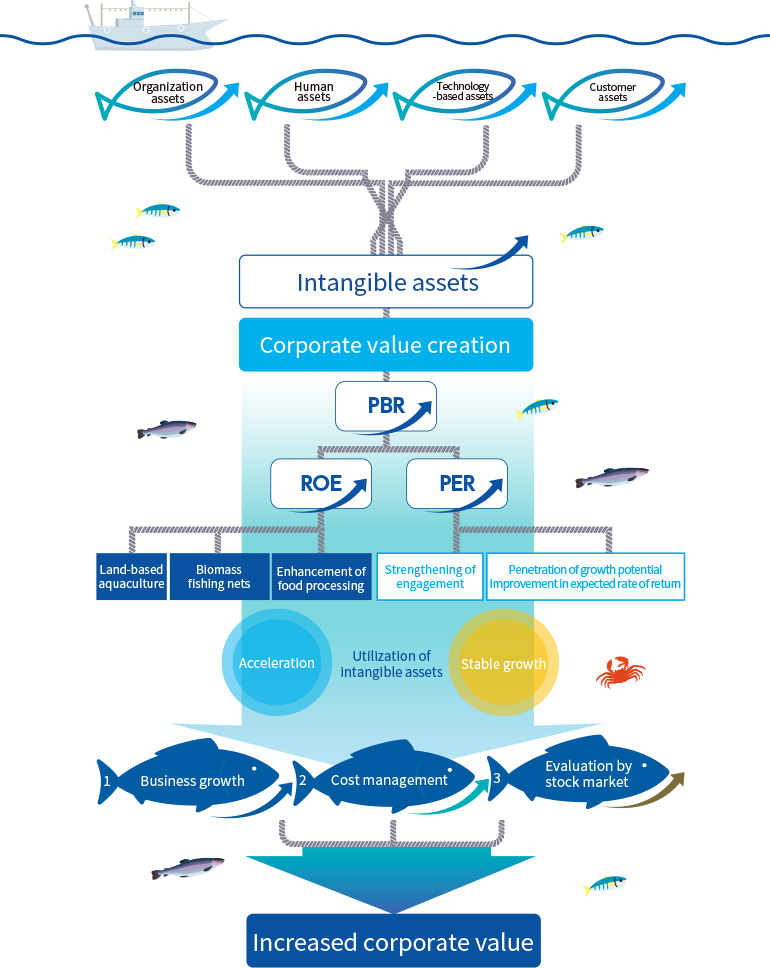

Basic approach to increasing corporate value and key financial indicators

Our mission to secure the listing on the Tokyo Stock Exchange Prime Market and serve the fishing and marine products industries another 100 years onwards

Since its foundation, Nichimo’s business foundation has been fishing and processing of marine products. With the support of fishing companies and many other stakeholders, we have developed services that meet diverse needs and striven to contribute to the development of society through our business. With the recent severe changes in the global economy, Japanese companies are facing increasingly tough demands each year in terms of capability and performance. The Tokyo Stock Exchange has recently reorganized its stock market to encourage higher performance among Japanese companies and attract investment by overseas investors. We have taken this as an excellent opportunity to review our purpose as a company and consider our corporate value and social responsibilities.

As a result, we reaffirmed our desire to continue providing services aligned with the Company’s philosophy and upholding our social responsibilities 100 years from now, and after considering how to increase our corporate value, decided to take the following initiatives. Moreover, we regard maintaining our listing on the Tokyo Stock Exchange Prime Market as an important milestone in the process of our initiatives to increase corporate value.

Definition of enterprise value

Business growth

Contributing to realizing a sustainable society through our business

Development of land-based aquaculture

Established Fish Farm Mirai LLC and built the largest land-based salmon aquaculture farm in Kyushu

Environmentally friendly sustainable food production and distribution

Practical application of biomass fishing nets

Practical application of biomass fishing nets that are biodegradable in the natural environment to reduce plastic waste and CO2 emissions

Reduction of environmental problems in the fishing industry

Building a system for the stable supply of marine products

Large-scale investments in labor- and power-saving and production efficiency increase, including the introduction of the latest manufacturing lines at two major manufacturing subsidiaries in Mombetsu City, Hokkaido.

System for the stable supply of high-value-added products

+

Regional revitalization

Use of stock market indices for increasing corporate value

Latest PBR=ROE×PER

Return on equity (ROE) was 11.1% (FY2022), and the share price was 3,083.3 yen (average closing price from January–March 2023). The price earnings ratio (PER) for FY2022, therefore, was 4.52 times, and the price-to-book ratio (PBR) was low at 0.50 times.

Increase in ROE × improvement of PER⇒Increase in PBR

*We aim to increase PBR and achieve an increase in enterprise value exceeding dissolution value (PBR=1)

Improvement of PER

Promote understanding of the Company’s revenue structure (business model) to enhance recognition of the Company’s sustainable creation and expansion of profit in the market.

Improve expected profit margin and ROE through promotion of growth strategies such as the medium-term management plan

Increase in ROE

Improve investment efficiency and profitability by promoting efficient management

Execution of strategies to increase corporate value by promoting specific management strategies

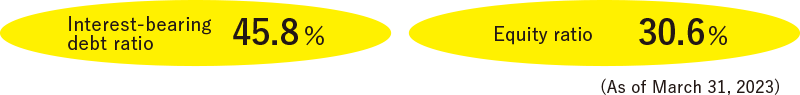

Awareness of improving the cost of capital to increase corporate value

Pursue the optimal capital structure to improve capital efficiency

Characteristics of the Company’s cash flow

Food Business

The fishing season for marine products is mainly from the early spring to early autumn. Purchases are made in advance.

Funds recovered by sales through to year-end

Marine Business, Machinery Business and Materials Business

Relatively short period from purchase to funds recovery

Balanced cash flow to cover the long recovery period for operating capital in Food Business

Enhancement of cash flow management, including reduction of recovery periods and inventories in each business

Improvement of operating cash flows

Based on a stronger financial position, also seek to enhance ROA and ROIC with an optimal capital structure