Corporate Governance

Basic approach

We consider achieving swift management decision-making in response to the fluctuating economic environment and increasing shareholder value through sound business management are the important issues for us. To achieve this, we are working to build strong relationships with our stakeholders, comprising first and foremost our shareholders, as well as our business partners, local society and our employees, and to enhance corporate governance as we strengthen and improve each of our functional bodies, including the Board of Directors and the Board of Executive Officers.

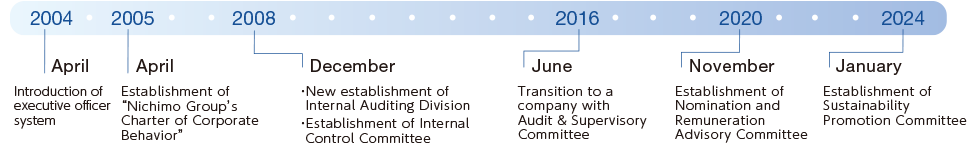

Changes to initiatives to strengthen corporate governance

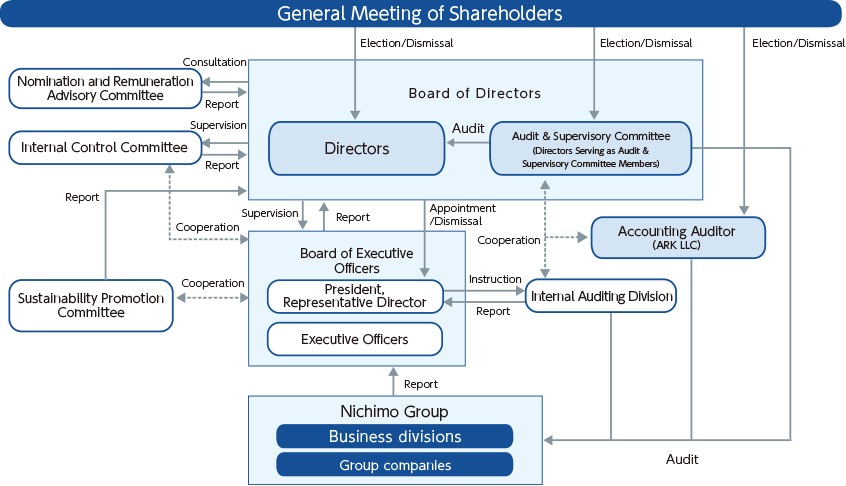

Corporate governance system

Board of Directors

The Board of Directors consists of six Directors (excluding Directors Serving as Audit & Supervisory Committee Member) and five Directors Serving as Audit & Supervisory Committee Member (four of which are Outside Directors). At its meetings, which are held once monthly in principle, important matters are determined in accordance with laws and regulations, the Articles of Incorporation and internal company rules, and the status of business execution is supervised by the Directors Serving as Audit & Supervisory Committee Member.

Results of activities

| Fiscal year | Meetings convened: Meetings with all Directors present |

|---|---|

| 2024 | 16 meetings in total: 16 meetings |

| 2023 | 16 meetings in total: 16 meetings |

Results of activities

- Important personnel changes

- Convening of the General Meeting of Shareholders as well as decisions on matters to be discussed and on proposals to be submitted to the General Meeting of Shareholders

- Approval of financial statements and their supplementary details, etc.

Audit & Supervisory Committee

The Audit & Supervisory Committee consists of the five Directors Serving as Audit & Supervisory Committee Member (four of which are Outside Directors) and holds meetings once monthly in principle. The Committee rigorously audits the execution of duties of the Directors (excluding Directors Serving as Audit & Supervisory Committee Member) and the Executive Officers, and diligently exchanges information with administrative departments such as the Internal Auditing Division and the Accounting Auditor.

Results of activities

| Fiscal year | Meetings convened: Meetings with all Committee Members present |

|---|---|

| 2024 | 14 meetings in total: 14 meetings |

| 2023 | 14 meetings in total: 14 meetings |

Results of activities

- Exchanges of information with the Representative Director

- Exchanges of information with Directors, etc.

- Exchanges of information with the presidents of Group companies, etc.

Nomination and Remuneration Advisory Committee

The Nomination and Remuneration Advisory Committee has been established as an optional advisory committee to the Board of Directors. It consists of five Directors (four of which are Outside Directors). The aim of the Committee is to obtain the appropriate involvement and advice of Independent Outside Directors to strengthen independence, objectivity and accountability, and to further enhance our corporate governance system when nominating Directors, determining important matters relating to remuneration, and so forth.

Results of activities

| Fiscal year | Number of meetings held |

|---|---|

| 2024 | 2 |

| 2023 | 3 |

Main matters resolved

- Matters regarding the appointment/dismissal of Directors

- Matters regarding the appointment/dismissal of Executive Officers

- Details of Director remuneration, etc.

Sustainability Promotion Committee

The Sustainability Promotion Committee is chaired by the President and Representative Director and consists of members selected by resolution of the Board of Directors. This Committee formulates a sustainability policy, identifies material issues (materiality) based on this policy, sets targets and reviews progress, and reports regularly to the Board of Directors.

Results of activities

| Fiscal year | Number of meetings held |

|---|---|

| 2024 | 4 |

Main matters resolved

- Matters related to the formulation and revision of sustainability policy

- Identification of material issues (materiality) based on sustainability policy, setting of targets and review of progress, etc.

Independence criteria and qualifications of independent Outside Directors

The appointment of independent Outside Directors is based on the requirements for Outside Directors set forth in the Companies Act and the independence standards stipulated by the Tokyo Stock Exchange. Additionally, the Company appoints as Outside Directors individuals (candidates) who have extensive knowledge and experience from years of work experience at other companies and who will oversee the legality and appropriateness of management of the Company and contribute to further improving the corporate governance system.

Reasons for appointment of independent Outside Directors

| Name | Reason for appointment |

|---|---|

| Tatsuya Kikuchi (Audit & Supervisory Committee Member) | Mr. Kikuchi was appointed based on his extensive experience and wide-ranging insight as a corporate manager, to supervise the legality and appropriateness of the Company’s management, and to contribute to the further enhancement of our corporate governance system. He is also expected to strengthen the independence, objectivity and accountability of the Board of Directors by offering appropriate involvement and advice as a member of the Nomination and Remuneration Advisory Committee. |

| Sunao Hirata (Audit & Supervisory Committee Member) | Mr. Hirata was appointed based on his broad insights gained through many years of experience in business operations at other companies, to supervise the legality and appropriateness of the Company’s management, and to contribute to the further enhancement of our corporate governance system. He is also expected to strengthen the independence, objectivity and accountability of the Board of Directors by offering appropriate involvement and advice as a member of the Nomination and Remuneration Advisory Committee. |

| Ninjo Akashi (Audit & Supervisory Committee Member) | Mr. Akashi was appointed based on his extensive experience and wide-ranging insight as a corporate manager, to supervise the legality and appropriateness of the Company’s management, and to contribute to the further enhancement of our corporate governance system. He is also expected to strengthen the independence, objectivity and accountability of the Board of Directors by offering appropriate involvement and advice as a member of the Nomination and Remuneration Advisory Committee. |

| Yumiko Yoshie (Audit & Supervisory Committee Member) | Ms. Yoshie was appointed based on her extensive experience and wide-ranging insight as an expert in fisheries, to supervise the legality and appropriateness of the Company’s management, and to contribute to the further enhancement of our corporate governance system. She is also expected to strengthen the independence, objectivity and accountability of the Board of Directors by offering appropriate involvement and advice as a member of the Nomination and Remuneration Advisory Committee. |

Activities of Directors and Audit & Supervisory Committee Members (FY2024)

| Name | Attendance at Board of Directors meetings | Attendance at Audit & Supervisory Committee meetings |

|---|---|---|

| Kazuaki Matsumoto | 16/16 meetings | |

| Shinya Aoki | 16/16 meetings | |

| Yoshitomo Yageta | 16/16 meetings | |

| Tadayoshi Koremura | 16/16 meetings | |

| Yoshiyuki Tsuchida | 16/16 meetings | |

| Toshihiko Suwabe | 16/16 meetings | |

| Toshio Yamamoto (Audit & Supervisory Committee Member) | 16/16 meetings | 14/14 meetings |

| Tatsuya Kikuchi (Audit & Supervisory Committee Member) | 16/16 meetings | 14/14 meetings |

| Sunao Hirata (Audit & Supervisory Committee Member) | 16/16 meetings | 14/14 meetings |

| Ninjo Akashi (Audit & Supervisory Committee Member) | 16/16 meetings | 14/14 meetings |

| Yumiko Yoshie (Audit & Supervisory Committee Member) | 11/11 meetings | 9/9 meetings |

Succession planning

To achieve its Corporate Philosophy and sustainably increase corporate value, the Group is establishing mechanisms and plans for taking specific measures and checking the progress of such in securing and developing long-term management talent. Until now, this was limited to establishing qualification grade criteria for general employees, managers, and executives, and setting up the training necessary for their promotions.

Going forward, we will strive to create an optimal succession plan that is linked to discussions of the Nomination and Remuneration Advisory Committee and that also takes into account the perspective of Group management.

Evaluation of effectiveness of the Board of Directors

With the aim of improving the functioning of the Board of Directors and ultimately increasing corporate value, the Company has a third-party organization conduct an annual survey of Directors to evaluate the effectiveness of the Board of Directors, and reports the results to the Board of Directors.

General matters regarding the Board of Directors, including its composition and operation method, the status of discussion, and cooperation with outside officers

To protect the anonymity of respondents, an independent organization was commissioned to collect, tabulate, and analyze the survey results.

Results of evaluation of effectiveness

FY2023

The evaluation was higher than the previous fiscal year’s results, and the effectiveness of the Board of Directors is thus judged to be ensured.

It was confirmed that the examination of the composition of the Board of Directors (the ratio of internal Directors to Outside Directors, and ensuring diversity in terms of gender and internationality) and training for officers, which were recognized as issues in the results of past surveys, have been improved through the measures taken this year. It was also confirmed that there is a need to further strengthen the supervision and monitoring of the establishment and operation of the internal control system for the entire Group, including subsidiaries.

FY2024

The results gave a generally positive evaluation, and the continued effectiveness of the Board of Directors is thus judged to be ensured.

With regard to the supervision and monitoring of the establishment and operation of the internal control system for the entire Group, including subsidiaries, which was recognized as an issue in the previous fiscal year’s results, we have recognized that while some improvement has been achieved through the review of the whistleblowing system, it is still an issue that must be addressed in order to further increase board effectiveness.

Going forward, the Company will fully discuss the issues identified in this evaluation and strive to respond swiftly, while continuing to make progress on initiatives to enhance the function of the Board of Directors, with the aim of further enhancing corporate governance. Moreover, we will aim to achieve a sustainable increase in corporate value by promoting sustainable management.

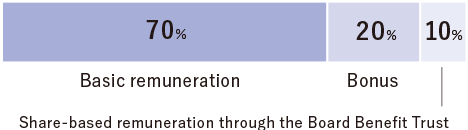

Officer remuneration system

Remuneration for Nichimo’s Directors consists of basic remuneration, bonuses as performance-linked remuneration and share-based remuneration through the Board Benefit Trust (non-monetary), based on a basic policy to determine a consideration for the level of contribution to improvement of corporate value and increase in share price, and guided by the corporate philosophy that we have followed since our founding: “In the spirit that a company is a public organ of society, we widely contribute to societal development with technologies and services that lead the industry.”

| Basic remuneration | Basic remuneration is monthly fixed remuneration, and it is determined based on consideration of the level of contribution to business performance according to position, business performance, social circumstances, remuneration levels of other companies, and other factors. The remuneration amount for Directors Serving as Audit & Supervisory Committee Member only consists of basic remuneration and the individual amounts shall be determined by discussion among the Directors Serving as Audit & Supervisory Committee Member within the scope of the maximum remuneration amount proposed and resolved in a general meeting of shareholders. |

|---|---|

| Bonuses as performance-linked remuneration | Determined based on business performance indicators, giving consideration to the degree of contribution to business performance according to position, social trends, and levels of remuneration in other companies globally. In addition, the business performance indicators are calculated based on the medium-term management plan and the degree of achievement for the fiscal year, using ordinary profit—a particularly important indicator for the Company—as the denominator. |

| Share-based remuneration through the Board Benefit Trust (non-monetary) | By further clarifying the link between remuneration and the Company’s share price so that Directors share with shareholders the benefits and risks of share price fluctuations, the Company works to increase Directors’ awareness of making the greatest possible contribution to increasing business performance over the medium- to long-term and expanding the Company’s value. With this aim, the Company grants points to Directors in each position based on their contribution to business results, up to a maximum of 15,000 points per fiscal year (1 point = 1 share). In principle, the Company will deliver shares* in accordance with the number of accumulated points granted to a Director upon their retirement.

|

Composition ratio of remuneration

The ratios of basic remuneration (monetary), bonuses (performance-linked remuneration), and share-based remuneration through the Board Benefit Trust (non-monetary) for each individual is based on the standard shown on the right, giving consideration to the degree of contribution to business performance of each position, the status of management, social trends, and remuneration levels at companies of a similar scale to the Company belonging to related industries or having related business models.

Cross-shareholdings

The Company classifies stocks held for the purpose of receiving profits from fluctuations in stock values or dividends as stocks held for purely investment purposes and other stocks as stocks held for purposes other than purely investment purposes.

The Company acquires and holds shares in business partners when it determines that such holdings will contribute to increasing the Company’s corporate value over the medium to long term from the perspective of building and strengthening relationships with those business partners and forming business alliances.

In addition, the Board of Directors examines individual cross-shareholdings each year in terms of the purpose of holding, transactional status and dividends, among other factors, and makes a comprehensive decision on whether to hold or reduce these shares.

Investment shares held for purposes other than purely investment purposes

| Classification | Number of stocks and amount on balance sheet | Stocks with an increase in the number of shares in FY2024 | Stocks with a decrease in the number of shares in FY2024 | Reasons for increase/decrease |

|---|---|---|---|---|

| Listed stocks | 18 stocks/6,974 million yen | 4 stocks/154 million yen | 5 stocks/206 million yen | Increase: Increase due to strengthening relationships with business partners and participating in business partner stock ownership plans |

| Unlisted stocks | 7 stocks/14 million yen | - | - | - |

Standards for exercising the voting rights of cross-shareholdings

The Company votes for or against a proposal after making a comprehensive judgment on whether it will contribute to increasing its corporate value and the medium- to long-term interests of its shareholders, investors, and other stakeholders.

Round-table Discussion of Outside Directors and Chairperson of the Board of Directors

Nichimo aims to be one of a kind,

so it should emphasize its own value more.

The Nichimo Group has launched a new Medium-Term Management Plan, marking the beginning of new challenges. Outside Directors Tatsuya Kikuchi, Sunao Hirata, Ninjo Akashi, and Yumiko Yoshie spoke with Chairperson of the Board of Directors and President Shinya Aoki, about the challenges and expectations for achieving sustainable growth and increasing Nichimo’s corporate value going forward.

Outside Director, Audit & Supervisory Committee Member

Tatsuya Kikuchi

Outside Director, Audit & Supervisory Committee Member

Sunao Hirata

President, Representative Director Chairperson of the Board of Directors

Shinya Aoki

Outside Director, Audit & Supervisory Committee Member

Ninjo Akashi

Outside Director, Audit & Supervisory Committee Member

Yumiko Yoshie

■ Kikuchi

The Fiscal 2023 Medium-Term Management Plan (the “previous medium-term plan”), which ran through the fiscal year ended March 2024, was a three-year period of rapid change from the beginning of the COVID-19 pandemic to the post-COVID era. During this time, society and the economy underwent dramatic changes that have had a major impact on business operations. It’s very impressive how Nichimo managed to overcome this difficult environment.

In the Food Business, the Company secured profits by shifting from its traditional business targeting restaurants to new channels such as mail-order sales. In the Machinery Business, Nichimo accurately captured the need for capital investment accompanying the expansion of mail-order demand. The other day, at a Board of Directors meeting, I proposed that we thoroughly analyze how the Company has been able to achieve good results despite the harsh business environment. On the other hand, Nichimo was a little slow in responding to new changes in the environment, and there were times when it was unable to keep up with the rapid changes in society. This is an issue that needs to be addressed in the future.

■ Hirata

I would like to talk about two points regarding the Company’s initiatives during the previous medium-term plan. The first is that information dissemination, especially in the area of investor relations, has improved markedly. Improvements to the Company’s website have greatly increased its appeal, and the Company also participated in the planning of a television drama. In the past, Nichimo’s products had few opportunities to be seen by consumers, but we have seen a dramatic increase in brand recognition and in Nichimo’s ability to disseminate IR information.

The second point is that while expanding business in growth areas, the Company also changed direction to address problematic businesses and policies, achieving better results through sound judgment. In terms of capital policy, Nichimo has taken risks and boldly implemented capital increases and stock splits with an eye toward increasing individual shareholders, and achieved great results.

On the other hand, the Company’s lack of a clear idea of its target profit level remains an issue. The idea of improving capital efficiency, such as what level of return is required on invested capital, has not yet been fully entrenched, and has been carried over to the Fiscal 2026 Medium-Term Management Plan (the “new medium-term plan”).

■ Kikuchi

As Mr. Hirata pointed out, Nichimo is currently engaging in proactive IR activities. These results have earned us positive recognition from the capital markets. The share price has been performing well, but it seems to have hit a plateau. Looking at these share price movements, I feel that the market is keeping a close eye. The capital markets may be waiting to gauge Nichimo’s next move. In order to meet market expectations, what actions is Nichimo planning to take regarding the marine industry and marine environmental conservation? Surely the Company needs to provide an answer to that question quickly.

■ Akashi

Looking back over the past three years, I would like to comment mainly on the sales side of things. Nichimo is a rare company that is both a manufacturer and a trading company. It leverages the core technologies it has cultivated over more than 100 years and applies them to meet modern needs. For example, the Company has brought marine materials made from biomass and biodegradable plastics to the market as products that will help achieve the SDGs, and the Company has received a certain amount of recognition from the capital market as a noteworthy manufacturer.

However, being a trading company comes with its own challenges. Going forward, sales personnel should be more active and demonstrate their capabilities. One of the issues that needs to be resolved in particular is the shortage of human resources. There is also much room for improvement in the limited opportunities for women to actively participate. As a manufacturer, the Company has excellent core technologies, so I would like it to strengthen sales capabilities and actively promote the appeal of those technologies. I would also like to see Nichimo demonstrate its presence as a corporate group that continues to provide environmentally friendly marine materials.

■ Yoshie

It has been one year since I was appointed as an Outside Director. During that time I have learned a lot about Nichimo’s business, including touring processing plants and witnessing the fierce price negotiations with supermarkets. I also learned about the Company’s efforts in mail-order sales, which I find very interesting. As Mr. Hirata pointed out, there has certainly been an improvement in the dissemination of information. This is especially evident when looking at the efforts made over the past six months. That being said, I also feel there is still a lot of room for improvement. There are additional avenues we can go down to make Nichimo more widely known among the general public.

One of the most important issues for Nichimo today is to actively appeal to the government and government agencies. In order to further develop Japan’s marine industry, concrete proposals

need to be put forward. By improving the Company’s ability to disseminate information in this way, more people will become aware of Nichimo, which will ultimately increase corporate value.

■ Aoki

Thank you all so much for all the valuable advice. One of the successes of the previous medium-term plan was that we chose to list on the Tokyo Stock Exchange Prime Market and were able to satisfy the listing criteria. Thanks to this decision, a mindset that embraces change has rapidly spread within the Company over the past year or two. There had been desire for change within the Company for some time, but we lacked the ability to actually see it through. The market restructuring helped to establish an awareness of the need for change, and I believe we have gained a lot from these past three years.

On the other hand, new issues have come to light. One is our lack of speed. As Mr. Akashi pointed out, while the Company prides itself on having high technological capabilities as a manufacturer, I feel that in sales we tend to be more of a “wait-and-see” type of company. Over the past three years, it has been difficult to adapt to the sudden changes in our business environment. We may not have had enough determination to overcome these powerful headwinds.

The much anticipated aquaculture business also did not proceed as originally planned. However, in our new medium-term plan, we are drawing up a new grand design using this experience as a springboard for growth. Since its founding, the Company has been focused on the marine products industry as the core of our business. The marine products industry is closely tied to national policy and has the advantage of being able to receive support for industrial development, but there is also a tendency to dependence on the government and constantly waiting for instructions. As Ms. Yoshie pointed out, we need to be more proactive in proposing to government agencies what we can do. We are aiming to increase our corporate value in the long term by taking all possible measures, including addressing environmental issues.

We will also be putting more effort into disseminating information, as pointed out by Mr. Hirata. Through dialogue with investors, we receive a wide range of advice, particularly regarding our approach to environmental issues. Our Outside Directors have long pointed out that Nichimo’s name recognition is still lacking. We will always be mindful of the importance of branding and continue to devote our efforts to promoting ourselves widely.

■ Kikuchi

Over the next three years covered by the Company’s new medium-term plan, we expect society to undergo even greater changes. In this environment, Nichimo must continue to grow while fulfilling its mission. I hope that all employees are aware of Nichimo’s mission as a company with deep knowledge of the sea in Japan, a maritime nation, and demonstrate their capabilities.

There are three areas that must be taken considered. The first is the conservation of the marine environment. Providing recycled and biodegradable materials and developing a business that protects the future of the ocean is a mission unique to Nichimo, and one that is sure to lead to new business opportunities.

The second is to promote fishing that adapts to environmental changes. As catches of saury and other fish continue to decline, it is important to utilize aquaculture technology to ensure a stable supply of fish that Japanese people enjoy. The aquaculture business will undoubtedly become a major pillar of Nichimo.

The third is the challenge of harnessing the power of the sea. There are many possibilities in the marine energy field, including offshore wind power generation. I expect Nichimo to work in cooperation with fishing companies to demonstrate its sales skills and develop new business ventures.

Nichimo carried out a large-scale organizational reform in April 2025, and it is important to use this as a step forward into fresh air.

These three themes are specified in the new medium-term plan, and the Company has begun town hall-style meetings across its business sites in Japan to advance dialogue between management and employees. I look forward to seeing all Nichimo employees facing the future and taking on new challenges together.

■ Hirata

There are three areas where I have high hopes for in the Company’s new medium-term plan. First, it establishes ROIC as a profit indicator. In the past, the awareness of ROIC was low, and there was a lack of in-depth discussion about investment projects, such as how much return could be obtained or how many years it will take to recoup the investment. Going forward, each department will need to be strictly aware of the return on invested capital and steadily pursue results.

The second is the town hall-style meetings that Mr. Kikuchi also mentioned. I hope that by providing a forum for direct dialogue between employees and management, Nichimo will be able to put in place a system that can resolve the variety of issues found in its workplaces. Among these, female participation is particularly important. It is essential to establish systems and continue to make improvements to create a workplace where women can play active roles. I have learned from my own experience that human resource issues cannot be resolved without solid policies put in place from the top down.

And the third is thorough support for management. I have always tried to convey advice at Board of Directors meetings in a straightforward way, even when making points that are hard to hear. Outside Directors have a responsibility to convey their respective knowledge to management and are expected to be proactive in making suggestions without fear of backlash. I hope that this advice will inspire new challenges and that it will be put to good use by the Company’s management.

■ Akashi

Regarding environmental issues, as Mr. Kikuchi mentioned, it is clear that the situation has become more serious compared to ten or even five years ago. Particular attention is being paid to issues concerning the atmosphere and oceans. During the period of the new medium-term plan, we will closely monitor how we are addressing these issues and look to make improvements.

The new medium-term plan uses the word “paradigm shift,” and organizational management also requires a transformation that takes into account the paradigm shift in society. Even in sales and technology, the Company tends to be trapped in traditional vertical thinking. We must emphasize horizontal connections between departments and break down barriers. Doing so will surely lead to new ideas and innovation.

By first considering what customers want and acting on that, Nichimo should be able to see the path that will bring it closer to where it wants to be in three and ten years’ time.

■ Yoshie

Over the past six months, I have been closely monitoring the progress of the new medium-term plan. This new medium-term plan has been drawn up with a view to the newly formulated Purpose and Vision, and also clearly sets targets for 10 years ahead.

As Mr. Hirata pointed out, promoting female participation in the workforce will become increasingly important in the future. As the Company continues to create a more comfortable work environment, the number of employees taking maternity leave, childcare leave, and family care leave will increase. These efforts need to include making sure that employees are seamlessly reintegrated upon returning to work after having been away for periods up to several years. Nichimo should foster a corporate culture where employees can return to work after several years with confidence, knowing that they will be able to make an impact after coming back.

In addition, strengthening the ability to disseminate information, which has already been mentioned, is an important theme that will help alleviate labor shortages. There is still much to be done, including enhancing communication targeted at students and actively utilizing internship opportunities.

■ Aoki

When considering female participation, we are of course very conscious of this and have put in place the necessary systems. However, operational issues have yet to be resolved, and I feel that we need to speed up our efforts in this area. I can really sympathize with the issues also pointed out by Mr. Kikuchi. Particularly in areas related to the Marine Business, there is an increasing number of points of contact with companies with different business formats, and unless we concentrate management resources in these areas, I believe we will not be able to make progress in building new businesses for the paradigm shift.

Our success is predicated on the bounty of the sea, and I believe that Nichimo’s mission is to maintain and expand these blessings. I strongly hope that all employees will take this sense of mission to heart and proactively take on various challenges.

■ Kikuchi

Nichimo is a company that aims not to be number one, but to be the only one. That is why I think it needs to dig deeper into the value of being the only one. It is very important for the Company to share this value with employees and hold it in common, as well as communicate it to society with confidence. If this value can be communicated to stakeholders, it will lead to increased corporate value, and the day will surely come when all of Japan will recognize Nichimo’s strengths and value.

■ Hirata

Japan’s marine products industry finds itself in a crisis. Looking at Japan’s White Paper on Fisheries, global aquaculture production is steadily increasing, and neighboring Asian countries are also increasing production, but Japan’s production is not. With issues such as rice shortages, I think Japan needs to give more thought to what it eats every day. Nichimo is a company that has the power to lobby and influence government regarding the marine products industry. Fulfilling its social responsibilities through such efforts will also help Nichimo to gain the trust of stakeholders.

■ Akashi

The key to Nichimo’s sustainable growth is human resources. In the current situation, recruitment is urgently needed to alleviate the labor shortage. On the other hand, I am keenly aware of our employees’ advanced capabilities. While this is not a cause for concern, what is crucially lacking is enthusiasm. The challenge is that many employees do not seem to have the drive to try things beyond their own boundaries. If we have the three elements of workforce, ability, and enthusiasm, we should be able to expand our business even more.

■ Yoshie

As a company that plays an indispensable role for Japan, Nichimo has access to central government agencies and I believe a strong voice. However, the reality is that this value has not been adequately communicated to the outside world. I think Nichimo needs to be more proactive in promoting the social value that it generates. This will also be useful in recruiting and developing personnel.

■ Aoki

I appreciate all of your valuable feedback. Nichimo is now moving on to a new stage where it will take on major challenges with an eye on the paradigm shift in society. We will continue to actively incorporate your opinions and those of others outside the Company and do our utmost to achieve sound growth. Thank you for today’s discussion.

Compliance

Basic views

The Group shall thoroughly comply with business ethics and social norms, such as legal compliance and matters prescribed in the “Nichimo Group’s Charter of Corporate Behavior,” and promote its “Compliance Program” in order to undertake its social mission as a company.

Compliance system

The Company has prescribed the “Nichimo Group’s Charter of Corporate Behavior” and the “Compliance Regulations,” which are based on the Company’s corporate philosophy, as the basis of the compliance system, distributes and raises awareness about them to the employees of all Group companies, and thoroughly carries them out throughout the Group, with the Board of Directors taking the initiative. Furthermore, the Company established the Compliance Committee chaired by the President and Representative Director, and operates it as an organization that maintains and promotes the “Compliance Program.”

Whistleblowing system

After establishing the “Whistleblowing System Regulations” in order to protect whistleblowers, the Company operates the whistleblowing system, with the officer in charge of compliance as the responsible person, as a system to promptly recognize organizational or individual fraud, illegal activities or unethical actions, and minimize and solve at an early stage the Company’s crisis from illegal activities, etc. In FY2024, we introduced an external reporting system within the Group and began operating it in conjunction with measures to promote awareness of the system. The aim is to improve the effectiveness of our systems in response to amendments to related laws and regulations, such as the enforcement of the amended Whistleblower Protection Act, and heightened awareness of compliance in society.

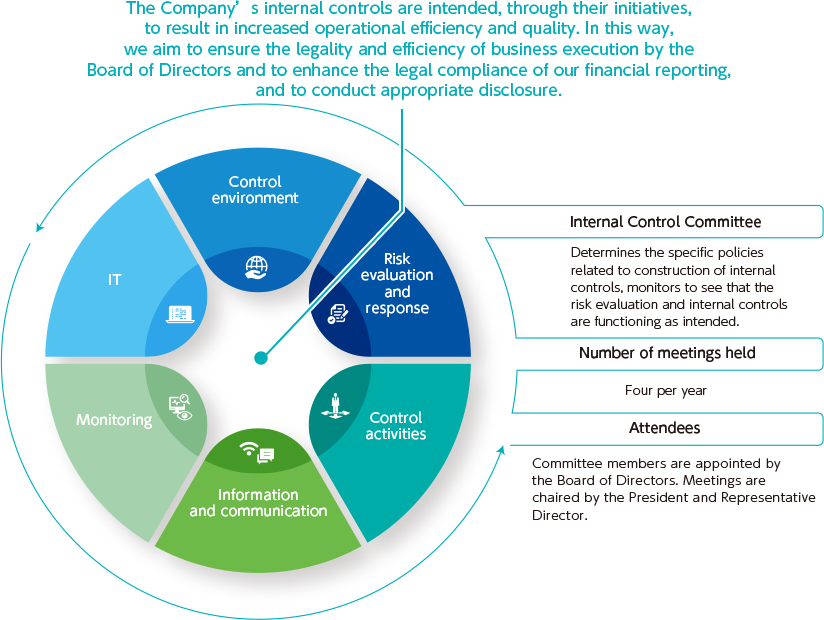

Internal control

The Company’s internal controls are intended, through their initiatives, to result in increased operational efficiency and quality. In this way, we aim to ensure the legality and efficiency of business execution by the Board of Directors and to enhance the legal compliance of our financial reporting, and to conduct appropriate disclosure. Furthermore, to achieve the objectives of our internal controls, we have arranged our business processes to incorporate responses to six basic elements: “control environment,” “risk evaluation and response,” “control activities,” “information and communication,” “monitoring,” and “IT”; and we have established structures for ensuring that these business processes are reliably executed.

Risk Management

Basic views

The Group stipulates the Crisis Management Guidelines, establishes basic countermeasures for crises and risks related to corporate management, and minimizes and solves at an early stage the risks that arise. Having established the Regulations for Risk Countermeasures for the response in the event that problems occur, the Company will swiftly respond and establish a system that prevents the increase of losses in the event that unforeseen circumstances occur.

Business continuity plan (BCP)

The Company distributes and raises awareness about the BCP manual to all employees in the event of a disaster, and has established a system that allows confirmation and response at any time. Furthermore, in the event of the spread of various infectious diseases or disasters, such as earthquakes, the Company establishes the Countermeasure Division, and ensures the safety of employees and carries out the response for business continuity in line with the manual.

Initiatives for food safety

With regard to food production, in addition to taking a leading role in ensuring that the Company responsibly provides products, the Food Quality Management Department establishes and thoroughly maintains and manages the quality control system, and carries out inspections at all the Group and partner plants in Japan and overseas. If the manufacturing lines of plants, management of employees, various bookkeeping, etc. do not satisfy the standards required by the Company, the Company will not be able to produce its products. As problems, such as contamination by foreign materials, will cause significant damage to business, the Company will identify the cause, apply an immediate remedy, and continue to thoroughly control quality and train employees.

Managing supply chain risks

The Group is presently exposed to various supply chain risks in its business domains. Geopolitical risks such as the impact of the protracted situation in Ukraine and heightened tensions in the Middle East, as well as drastic fluctuations in foreign exchange rates, are causing procurement difficulties and high prices for raw materials and energy. The Company has taken response measures, such as using a variety of purchasing channels, diversifying its procurement regions and implementing appropriate inventory management in response to risk. The Company also audits and revises the Group’s risk management system as needed.

Management of information security and system operations

The Group has established the Information Security Management Regulations and has prepared the information security systems necessary for safe and rational operation of information systems and protection of information assets such as personal information and company secrets.

We define information security as protecting information assets from threats and keeping them in a state where they can be managed appropriately and used with confidence, working to guarantee their “confidentiality,” “completeness,” and “availability.”

Furthermore, to ensure appropriate operation of the Group’s information systems, we have established the Information System Operation Committee, which is chaired by the Director in charge of the administrative section, and we have adopted a structure for appropriately revising, maintaining, and promoting regulations, organizations, and management structure, and so forth, related to information systems.

Initiatives for the climate change risks

As one of the specific initiatives for promoting sustainable management, the Group recognized the issue of climate change as a key management issue, and declared its agreement with the recommendations of the Task Force for Climate-related Financial Disclosures (TCFD) in April 2023. In addition, following the framework proposed by the TCFD, at the Sustainability Promotion Committee under the supervision of the Board of Directors, the Company is assessing the level of impact of the risks and opportunities that will be brought to the Group’s businesses by climate change in the future using the scenario analysis method. Please see here for details of the Company’s response to climate change (information disclosure based on the TCFD recommendations).