Corporate Governance

Basic approach

We consider achieving swift management decision-making in response to the fluctuating economic environment and increasing shareholder value through sound business management are the important issues for us. To achieve this, we are working to build strong relationships with our stakeholders, comprising first and foremost our shareholders, as well as our business partners, local society and our employees, and to enhance corporate governance as we strengthen and improve each of our functional bodies, including the Board of Directors and the Board of Executive Officers.

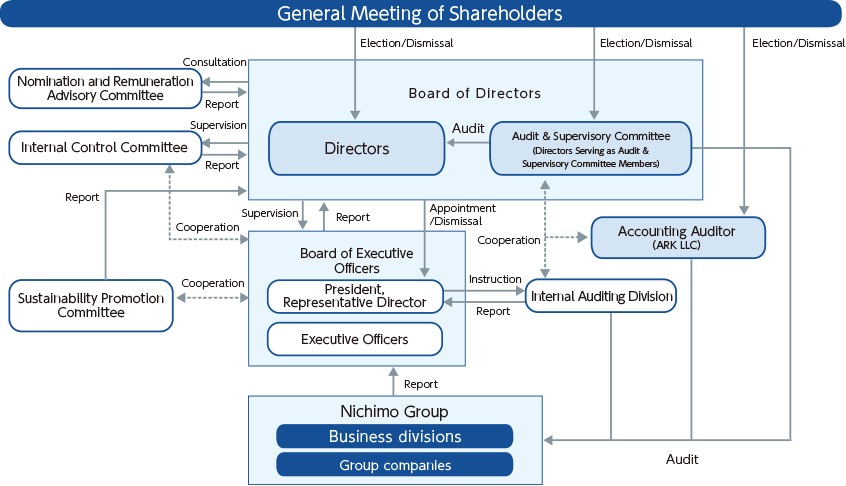

Corporate governance system

Board of Directors

The Board of Directors consists of six Directors (excluding Directors Serving as Audit & Supervisory Committee Member) and four Directors Serving as Audit & Supervisory Committee Member (three of which are Outside Directors). At its meetings, which are held once monthly in principle, important matters are determined in accordance with laws and regulations, the Articles of Incorporation and internal company rules and the status of business execution is supervised by the Directors Serving as Audit & Supervisory Committee Member.

| Fiscal year | Meetings convened : Meetings with all Directors present |

|---|---|

| FY2022 | 16 meetings in total : 16 meetings |

| FY2021 | 16 meetings in total : 15 meetings |

Audit & Supervisory Committee

The Audit & Supervisory Committee consists of the four Directors Serving as Audit & Supervisory Committee Member (three of which are Outside Directors) and holds meetings once monthly in principle. The committee rigorously audits the execution of duties of the Directors (excluding Directors Serving as Audit & Supervisory Committee Member) and the Executive Officers, and diligently exchanges information with administrative departments such as the Internal Auditing Division and the Accounting Auditor.

| Fiscal year | Meetings convened: Meetings with all Committee Members present |

|---|---|

| FY2022 | 14 meetings in total : 14 meetings |

| FY2021 | 14 meetings in total : 14 meetings |

Nomination and Remuneration Advisory Committee

The Nomination and Remuneration Advisory Committee has been established as an optional advisory committee to the Board of Directors. It consists of four Directors (three of which are Outside Directors). The aim of the committee is to obtain the appropriate involvement and advice of Independent Outside Directors to strengthen independence, objectivity and accountability, and to further enhance our corporate governance system when nominating Directors, determining important matters relating to remuneration, and so forth.

| Fiscal year | Number of meetings held | Main matters resolved |

|---|---|---|

| FY2022 | 3 | Matters regarding the appointment/dismissal of Directors, matters regarding the appointment/dismissal of executive officers, and details of Director remuneration, etc. |

| FY2021 | 3 |

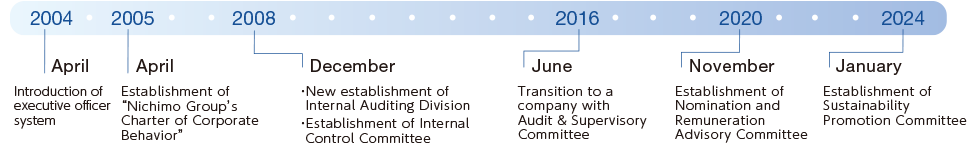

Changes to initiatives to strengthen corporate governance

Officer remuneration system

Remuneration for Nichimo’s Directors consists of basic remuneration, bonuses as performance-linked remuneration and share-based remuneration through the Board Benefit Trust (non-monetary) , based on a basic policy to determine a consideration for the level of contribution to improvement of corporate value and increase in share price, and guided by the corporate philosophy that we have followed since our founding: “In the spirit that a company is a public organ of society, we widely contribute to societal development with technologies and services that lead the industry.”

| Basic remuneration | Basic remuneration is monthly fixed remuneration, and it is determined based on consideration of the level of contribution to business performance according to position, business performance, social circumstances, remuneration levels of other companies, and other factors. The remuneration amount for Directors Serving as Audit & Supervisory Committee Member only consists of basic remuneration and the individual amounts shall be determined by discussion among the Directors Serving as Audit & Supervisory Committee Member within the scope of the maximum remuneration amount proposed and resolved in a general meeting of shareholders. |

|---|---|

| Bonuses as performance-linked remuneration | Determined based on business performance indicators, giving consideration to the degree of contribution to business performance according to position, social trends, and levels of remuneration in other companies globally. In addition, the calculation methods for business performance indicators use ordinary profit—a particularly important indicator for the Company—as the denominator, to calculate based on the medium-term management plan and the degree of achievement for the fiscal year. |

| Share-based remuneration through the Board Benefit Trust (non-monetary) | By further clarifying the link between remuneration and the Company’s share price so that Directors share with shareholders the benefits and risks of share price fluctuations, the Company works to increase Directors’ awareness of making the greatest possible contribution to increasing business performance over the medium- to long-term and expanding the Company’s value. With this aim, the Company grants points to Directors in each position based on their contribution to business results, up to a maximum of 15,000 points per fiscal year (1 point = 1 share). Moreover, in principle, the Company will deliver shares in accordance with the number of accumulated points granted to a Director upon their retirement. |

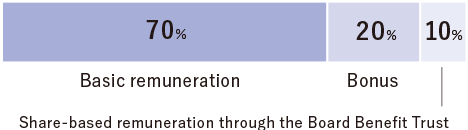

Composition ratio of remuneration

The ratios of basic remuneration (monetary), bonuses (performance-linked remuneration), and share-based remuneration through the Board Benefit Trust (non-monetary) for each individual is based on the standard shown on the right, giving consideration to the degree of contribution to business performance of each position, the status of management, social trends, and remuneration levels at companies of a similar scale to the Company belonging to related industries or having related business models.

Evaluation of effectiveness of the Board of Directors

We have been carrying out questionnaires on the evaluation of effectiveness of the Board of Directors annually with the objective of improving the functionality of the Board of Directors, which will lead to increasing our corporate value. When responding to the questionnaire, anonymity was ensured by having the completed questionnaires sent directly to an external body, and the collated results are reported to the Board of Directors.

General matters regarding the Board of Directors, including its composition and operation method, the status of discussion, and cooperation with outside officers

To protect the anonymity of respondents, an independent organization was commissioned to collect, tabulate, and analyze the survey results.

Results of evaluation of effectiveness

FY2021

The results gave a generally positive evaluation, and the effectiveness of the Board of Directors is thus judged to be ensured.

Of the issues recognized by the results of the previous survey, it was confirmed that improvement was progressing for discussions by the Board of Directors as opportunities for discussion increased, such as during the formulation of the Fiscal 2023 Medium-Term Management Plan and planning for compliance with the criteria for continued listing for the Tokyo Stock Exchange Prime Market. With regard to issues going forward, as with the previous survey, issues such as taking into consideration the composition of the Board of Directors (ratio of Inside Directors to Outside Directors, ensuring of diversity in gender and internationality) were raised in addition to room for improvement being confirmed with regard to officer training for the further improvement of functions of the Board of Directors.

FY2022

The results gave a generally positive evaluation, and the effectiveness of the Board of Directors is thus judged to be ensured.

We recognized that there are ongoing issues identified in the results of the previous survey concerning taking into consideration the composition of the Board of directors (ratio of Inside Directors to Outside Directors, ensuring of diversity in gender and internationality) and officer training for the further improvement of functions of the Board of Directors. We also identified new issues regarding support systems for Directors, such as coordination with the Internal Auditing Division.

Going forward, the Company will fully discuss the issues identified in this evaluation and strive to respond swiftly, while continuing to make progress on initiatives to enhance the function of the Board of Directors, with the aim of further enhancing corporate governance.

Moreover, we will aim to achieve a sustainable increase in corporate value by promoting sustainable management.

Interview with Outside Directors

Nichimo’s appeal should be publicized more strongly

Outside Director, Audit & Supervisory Committee Member

Ninjo Akashi

Outside Director, Audit & Supervisory Committee Member

Tatsuya Kikuchi

Outside Director, Audit & Supervisory Committee Member

Sunao Hirata

Please share your thoughts regarding Nichimo’s business activities.

■ Kikuchi

Having supplied fishing nets and gear for fishing vessels since its foundation, Nichimo was heavily impacted by the 200 nautical mile limit introduced in 1975, and since then has expanded into the food business and machinery business. Nichimo’s business is still centered on the ocean today, and it is a very important company with a significant role to play for Japan as a maritime nation. This is now the eighth year since I was appointed as Outside Director. Over this time, I have noted the deep love of the ocean among the management team and employees, and listened to them with great interest while offering my own advice. The impact of the COVID-19 pandemic has been a concern for the past three years, but in the end, the Company was able to overcome various difficulties and deliver stable results. The well-balanced business portfolio proved successful, as the Company made up for the impact on the restaurant industry by capturing stay-at-home demand, and so forth. Over these three years, the Machinery Business has also grown stronger. I feel that these points show the strength of Nichimo and the appeal of its business.

■ Hirata

Since becoming an Outside Director in 2018, I have been privileged to be involved in the management of a company with over 110 years of history. It is often said that companies with long histories have a great deal of tacit knowledge. The company spirit and culture that has been developed at Nichimo over its long history is surely an extremely powerful mental support for the many employees who work here. On the other hand, the Company also needs to respond to new challenges arising from changes in its business environment, such as depletion of marine resources and dietary changes in Japan and neighboring countries, by working hand-in-hand with employees and bringing together their wisdom.

■ Akashi

I was appointed Outside Director in June 2022, and although it is still early days for me, I felt as though I already had an understanding of Nichimo’s business from working at a Group company. However, since my appointment as Outside Director of Nichimo, I have gained a renewed sense of the breadth of the field of the marine industry. Speaking for myself personally, and people that I know, I think there are many people who do not have a correct understanding of just how marvelous Nichimo’s business is. Amid rising interest in the Sustainable Development Goals (SDGs), I think that Nichimo should be more active in publicizing its initiatives for contributing to solutions to environmental and social issues through the reinvigoration of the marine industry. As an Outside Director, I hope to contribute to the publicizing of this information.

What is your assessment of Nichimo’s governance and sustainable management?

■ Kikuchi

Company governance systems are becoming more advanced under the Corporate Governance Code , but the important thing is to enhance the “content” rather than to upgrade the “framework.” It is important for Inside and Outside Directors to talk openly and honestly, and have deeper discussions. Nichimo has elected the structure of a company with an audit and supervisory committee, and has an excellent governance system. On top of this, it is also focused on enhancing the “content,” through measures like actively providing opportunities for Outside and Inside Directors to have open and honest discussions. For example, ahead of the regular Board of Directors meetings, the Company holds a lunch meeting for all of the board members, which provides a casual setting for them to exchange opinions.

■ Hirata

It is certainly important to have opportunities for the members of the Board of Directors to have open and honest discussions. The three members here also serve as Audit & Supervisory Committee Members, and opportunities for discussion between President Matsumoto, Senior Managing Director Yageta, and the other four Inside and Outside Audit & Supervisory Committee Members are also provided each quarter. We can engage in frank discussion at these meetings, and I think this shows excellent consideration. In a sense, initiatives to enhance the effectiveness of the Board of Directors may be a never-ending task. All Directors, including Outside Directors need to be prepared to strive continuously to respond to changes in the business environment.

■ Akashi

Speaking from the perspective of sustainable management, Nichimo has many possibilities and issues that it should address. One topic that comes up repeatedly for discussion in the Board of Directors is the development of biodegradable plastic. This is the easiest area to address from a perspective of the SDGs, in particular, prevention of environmental pollution, but I think there is still a lack of urgency about it. We should actively invest management resources to increase the pace of development. We also need a quick answer to the issue of reusing discarded fishing nets.

■ Kikuchi

In terms of sustainable management, I think that one key issue that Nichimo needs to address urgently is promoting the active participation of women. There may be reasons why recruitment of women has not made much progress, for example, the specialized field of the Marine Business and Nichimo not having a high profile. However, if the Company does not secure diverse human resources, including women, and take advantage of their rich ideas, it will lose flexibility as a company. For this reason I think it is an important issue.

■ Hirata

That is really true. Human resources don’t suddenly deliver great performance just by hiring them and assigning them. We can assign women to managerial roles, but the management also needs to change its awareness and create a culture and systems that enable women to fit into the organization successfully. The same applies for female Directors. I recently visited the Group company Yamaichi Suisan Co.,Ltd. at Mombetsu as an Audit & Supervisory Committee Member. I saw that while the personnel are growing older, they are making use of technical trainees from Vietnam and so forth. I was impressed to see that careful consideration was given to the trainees, such as explaining the controls of the machinery to them in their native language.

Finally, please talk about your expectations for Nichimo’s future.

■ Hirata

Nichimo has a large number of Group companies, and I have seen many Group companies added through M&A since my appointment as Outside Director in 2018. I think that diversification of the business portfolio will contribute significantly to Nichimo’s sustainable growth in the future. Looking ahead, it will be important to pursue synergies and share expertise between Group companies, and to promote their integration.

■ Kikuchi

Nichimo has a large number of strong products. For example, even rival manufacturers use surimi supplied by Nichimo to process their kamaboko products, and Nichimo provides the protective netting installed at Major League Baseball stadiums in the United States. These applications are not immediately visible to end users, but I think that Nichimo should publicize the existence of such strong products more vigorously, and promote its potential more.

■ Akashi

I am very excited about the future of the land-based salmon aquaculture farm being operated with Kyushu Electric Power Company, Incorporated, and other partners . There are still a number of issues to overcome , but the Company is looking at co-creation with a range of industries, including the introduction of semiconductor and imaging technology. I would love to see the Company create fish that are delicious and appealing even to children who do not like fish.

Compliance

Basic views

The Group shall thoroughly comply with business ethics and social norms, such as legal compliance and matters prescribed in the “Nichimo Group’s Charter of Corporate Behavior,” and promote its “Compliance Program” in order to undertake its social mission as a company.

Compliance system

The Company has prescribed the “Nichimo Group’s Charter of Corporate Behavior” and the “Compliance Regulations,” which are based on the Company’s corporate philosophy, as the basis of the compliance system, distributes and raises awareness about them to the employees of all Group companies, and thoroughly carries them out throughout the Group, with the Board of Directors taking the initiative. Furthermore, the Company established the Compliance Committee chaired by the President, Representative Director, and operates it as an organization that maintains and promotes the “Compliance Program.”

Whistleblowing system

After establishing the “Whistleblowing System Regulations” in order to protect whistleblowers, the Company operates the whistleblowing system, with the officer in charge of compliance as the responsible person, as a system to promptly recognize organizational or individual fraud, illegal activities or unethical actions, and minimize and solve at an early stage the company crisis from illegal activities, etc.

Internal control

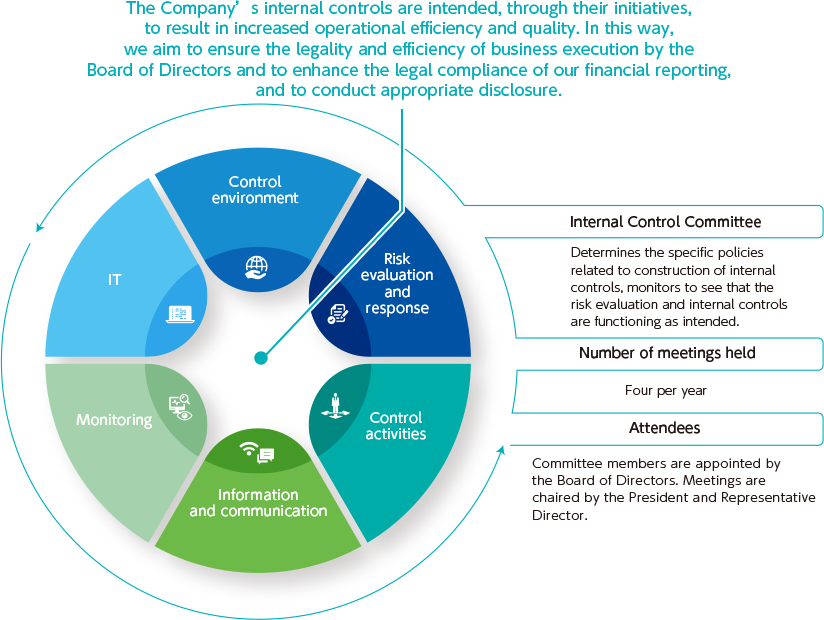

The Company’s internal controls are intended, through their initiatives, to result in increased operational efficiency and quality. In this way, we aim to ensure the legality and efficiency of business execution by the Board of Directors and to enhance the legal compliance of our financial reporting, and to conduct appropriate disclosure. Furthermore, to achieve the objectives of our internal controls, we have arranged our business processes to incorporate responses to six basic elements: “control environment,” “risk evaluation and response,” “control activities,” “information and communication,” “monitoring,” and “IT”; and we have established structures for ensuring that these business processes are reliably executed.

Risk management

Basic views

The Group stipulates the “Regulations for Risk Countermeasures,” establishes basic countermeasures for crises and risks related to corporate management, and minimizes and solves at an early stage the risks that arise. Having established the Crisis Management Guidelines for the response in the event that problems occur, the Company will swiftly respond and establish a system that prevents the increase of losses in the event that unforeseen circumstances occur.

Business continuity plan (BCP)

The Company distributes and raises awareness about the BCP manual to all employees in the event of a disaster, and has established a system that allows confirmation and response at any time.

Furthermore, in the event of the spread of various infectious diseases or disasters, such as earthquakes, the Company establishes the Countermeasure Division, and ensures the safety of employees and carries out the response for business continuity in line with the manual.

Initiatives for food safety

With regard to food production, in addition to taking a leading role in ensuring that the Company responsibly provides products, the Food Quality Management Department establishes and thoroughly maintains and manages the quality control system, and carries out inspections at all the Group and partner plants in Japan and overseas. If the manufacturing lines of plants, management of employees, various bookkeeping , etc. do not satisfy the standards required by the Company, the Company will not be able to produce its products. As problems, such as contamination by foreign materials, will cause significant damage to business, the Company will identify the cause, apply an immediate remedy, and continue to thoroughly control quality and train employees.

Managing supply chain risks

The Company is presently exposed to various supply chain risks in its business domains. Inflationary pressure due to the impact of the protracted situation between Russia and Ukraine and the yen’s depreciation is causing procurement difficulties and high prices for raw materials and energy. The Company has taken response measures, such as using a variety of purchasing channels, diversifying its procurement regions and implementing appropriate inventory management in response to risk. The Company also audits and revises the Group’s risk management system as needed.

Management of information security and system operations

The Group has established the Information Security Management Regulations and has prepared the information security systems necessary for safe and rational operation of information systems and protection of information assets such as personal information and company secrets. We define information security as protecting information assets from threats and keeping them in a state where they can be managed appropriately and used with confidence, working to guarantee their “confidentiality,” “completeness,” and “availability.” Furthermore, to ensure appropriate operation of the Group’s information systems, we have established the Information System Operation Committee, which is chaired by the Director in charge of the administrative section, and we have adopted a structure for appropriately revising, maintaining, and promoting regulations, organizations, and management structure, and so forth, related to information systems.

Initiatives for the climate change risks

As one of the specific initiatives for promoting sustainable management outlined in the Company’s Fiscal 2023 Medium-Term Management Plan, the Company recognized the issue of climate change as a key management issue, and declared its agreement with the recommendations of the Task Force for Climate-related Financial Disclosures (TCFD) in April 2023. In addition, following the framework proposed by the TCFD, at the Internal Control Committee under the supervision of the Board of Directors, the Company has started to assess the level of impact of the risks and opportunities that will be brought to its businesses by climate change in the future using the scenario analysis method. Going forward, we will expand these initiatives to include disclosure of the impact on the Company’s financial position. Please see here for details of the Company’s response to climate change (information disclosure based on the TCFD recommendations)