Overview of “Fiscal 2026 Medium-Term Management Plan (Breaking Through Toward 2028)”

The basic concept of the Fiscal 2026 Medium-Term Management Plan (the “new medium-term plan”) is to “strengthen core businesses and stabilize earnings structure.” This represents our efforts to strengthen our core businesses by continuing to provide long-term support throughout the entire supply chain as a solutions partner for the fishing and marine products industries, and to stabilize our earnings structure by restructuring our business portfolio to achieve a better balance. We will also actively consider M&A as a way to achieve these aspirations.

In addition, we implemented various awareness-raising measures, including town hall-style meetings, as well as communicated and shared our plans and ideas with the entire Group, aiming to create a new medium-term plan that all employees would understand and take ownership of.

Strengthen core businesses and stabilize earnings structure

| 01 | Support the marine products industry supply chain |

|---|---|

| 02 | Restructure the business portfolio |

| 03 | Actively implement M&A to expand business |

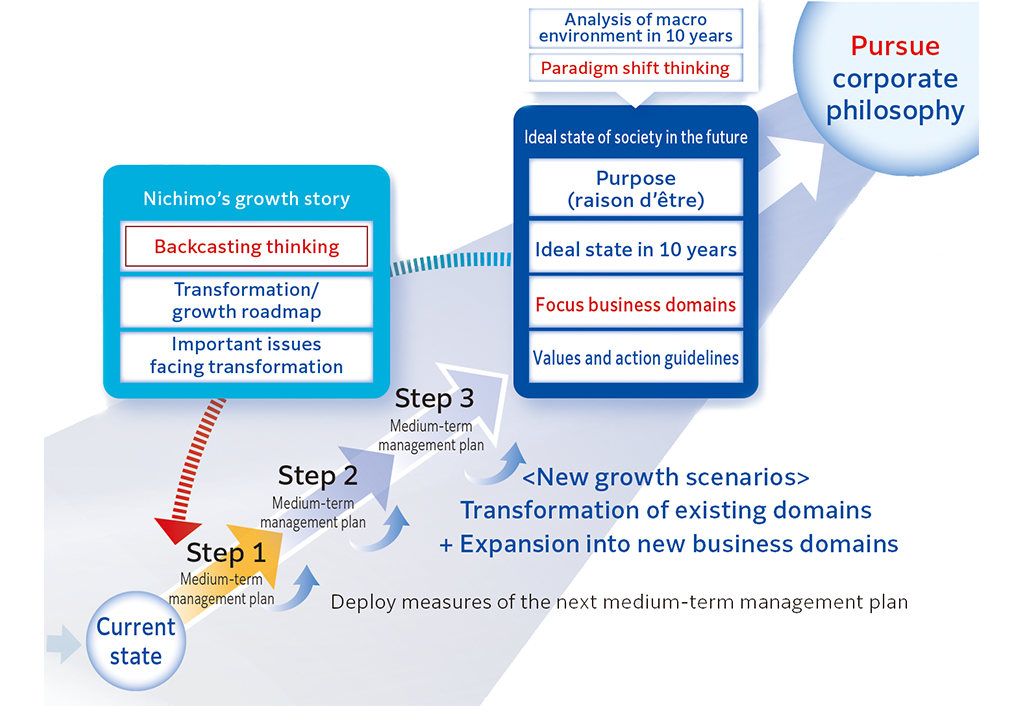

Positioning of long-term vision and medium-term management plan

In formulating the new medium-term plan, in order to respond to the paradigm shift occurring in the marine products industry and future changes in the business environment that are difficult to predict, we have shifted our planning from a past-driven, cumulative approach to a backcasting approach.

Specifically, while pursuing our unchanging corporate philosophy, we envisioned the world we want to realize and our ideal state in 10 years, and defined our Purpose as “From Ocean To Dining, Challenges For The Better Future.” For each business, we analyzed the business environment 10 years in the future and formulated a long-term vision, then worked backwards from there to create plans and strategies. For this reason, we are positioning the new medium-term plan as a three-year period for making a breakthrough, with an eye toward 10 years in the future.

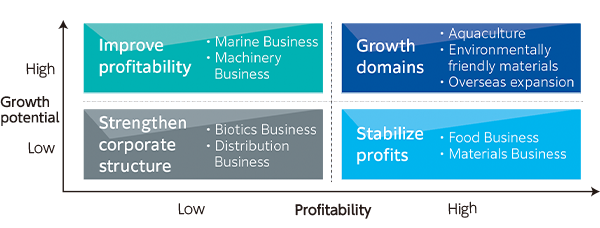

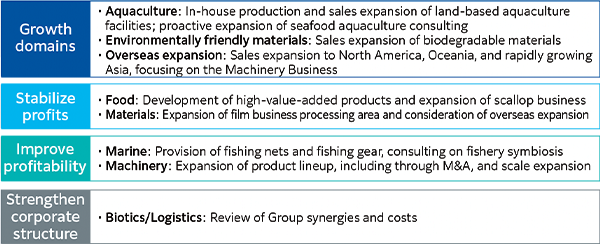

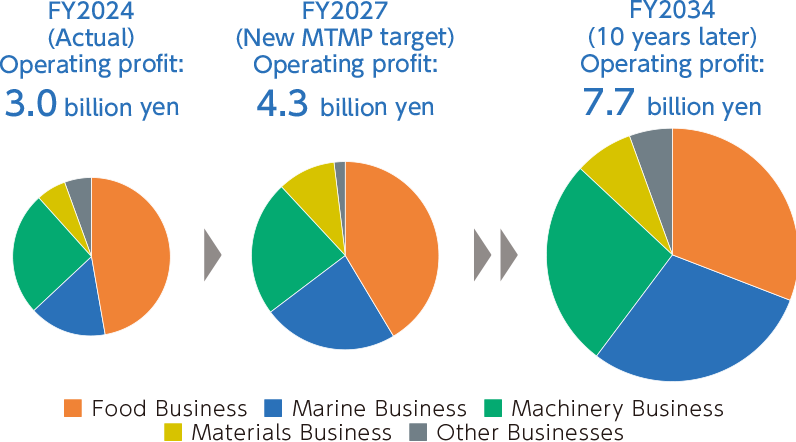

Transformation of business portfolio

The main focus of our measures will be to grow profits and stabilize the earnings structure. The first is to further develop the earnings base established under the previous medium-term plan and continue building upon it with the new medium-term plan, and to accelerate the pace of profit growth towards the target of 7.7 billion yen in operating profit 10 years from now. The second is to transform our current earnings structure, which relies on the Food Business for roughly half of its profits. We aim to make it more stable by expanding the Marine Business and Machinery Business, ultimately creating three well-balanced pillars.

Additionally, we conducted a business feasibility assessment that took into account the Company’s raison d’être in 10 years, market expansion forecasts for each product and business, and the advantages of our products, and classified them into four areas.

We will continue to manage each area in a way that suits its characteristics and move forward with business portfolio restructuring.

Operating profit target values

KPI

In addition to the traditional ROE, we will also use ROIC and D/E ratio as key management indicators. Our targets are an ROIC of 4.5% or more to emphasize capital efficiency, and a D/E ratio within 1.0 to maintain a sound financial position.

Over the three-year period of the new medium-term plan, we will raise operating profit to the 4 billion yen range and further solidify our foothold for unlocking significant growth thereafter.

| Results for fiscal year ended March 31, 2025 | Targets for fiscal year ending March 31, 2028 | Targets for fiscal year ending March 31, 2035 | |

|---|---|---|---|

| Net sales(Millions of yen) | 133,900 | 155,000 | 230,000 |

| Operating profit(Millions of yen) | 3,002 | 4,300 | 7,700 |

| Ordinary profit(Millions of yen) | 3,601 | 4,500 | 7,900 |

| ROE | 9.1% | 10% or more | 12% or more |

| ROIC | 4.0% | 4.5% or more | 6.0% or more |

| D/E ratio | 1.2 | 1.0 or less | 0.9 or less |

Investment strategy

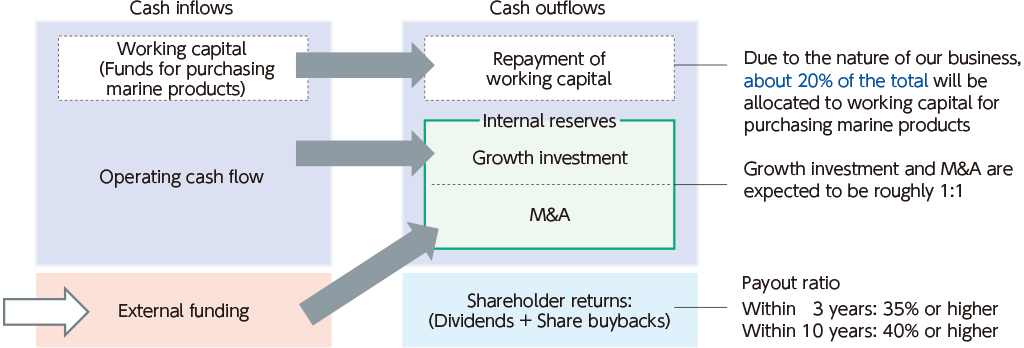

The cash allocation structure envisioned for the medium to long term (10 years) involves utilizing operating cash flow and borrowings to make active growth investments and return profits to shareholders.

Key points of the new medium-term plan over the next three years include focusing on business areas and products for future growth over the next 10 years, with plans for significant capital investments and M&A activities, along with additional external funding through borrowings.

- *Diagram of cash allocation over the next 10 years

Dividend policy

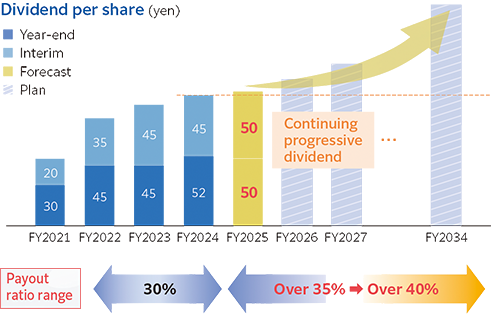

Looking at our medium- to long-term dividend policy for the next three and ten years, during the new medium-term plan, we will maintain our basic policy of stable dividends as before, while continuing our effective progressive dividend policy. Our intention is to raise the payout ratio to 35% or more by FY2027, three years from now. We will also consider rolling out shareholder benefits and share buybacks, which have been requested by many investors.

With regard to shareholder return measures from a medium- to long-term perspective, we will actively return profits to shareholders, targeting a payout ratio of 40% or more and a DOE of 4% or more as soon as possible. This, however, will depend on business performance trends.