Dialogue Nichimo Group’s Financial Strategy

Financial structure for ensuring stable profits

■ Kojima

The financial results for FY2024 showed higher revenue and profits compared to the previous fiscal year. During the “Fiscal 2023 Medium-Term Management Plan (Toward the next stage)” (the “previous medium-term plan”), we achieved our final year targets, except for operating profit and ROE. Over the past three years, we have maintained a trend of rising revenue and profits, and are improving our profit structure to generate stable profits while adapting to changes in the business environment.

On the other hand, ROE is an issue. ROE fell from 14.8% in FY2021 to 11.1% in the first year of the previous medium-term plan, 9.0% in the second year, and to 9.1% in the final year. The main factors behind this downturn include a capital increase of approximately 1.9 billion yen, which was not anticipated when the previous medium-term plan was formulated, and an increase in shareholders’ equity due to an increase in unrealized gains on investment securities. As a result of these factors, ROE decreased following the increase in shareholders’ equity. To improve ROE going forward, profit growth is needed to fully compensate for the increase in shareholders’ equity.

■ Ueda

I have been in finance for around two decades. During times of challenging business performance, the Group’s shareholders’ equity ratio was in the low 20% range. This increased to 36.4% in FY2024. It is true that the increase in shareholders’ equity has pushed down ROE. Yet, this is a desirable outcome in terms of financial stability. Due to the Group’s business structure, we have a large inventory of marine products, and frankly speaking, we want to ensure a certain level of shareholders’ equity to back this inventory.

Issues remain in M&A and capital investment

■ Kojima

To be honest, over the past three years our investment plans have not progressed as hoped. One issue that stood out in particular was M&A, as we were unable to make much progress. However, we do not want to just settle on any target company. We need to have a thorough discussion within the Company about how we think about M&A and raise awareness.

■ Ueda

Capital investment, too, has not gone as smoothly as we had hoped. Although the construction of the scallop plant in Mombetsu has gone as planned, capital investments in marine materials using biomass and biodegradable materials are not progressing as expected. Additionally, DX-related investments, such as system investments, remain an important issue.

Financial strategy of the new medium-term management plan

Target setting using backcasting

■ Ueda

A key point in our recently launched “Fiscal 2026 Medium-Term Management Plan (Breaking Through Toward 2028)” (the “new medium-term plan”) is the adoption of backcasting. When drawing up the plan, we respected the figures provided by each sales department as we had done in the past, but also set performance targets by working backwards from those figures based on our ideal state in three and ten years’ time. Additionally, the quantitative targets for the new medium-term plan have been set with a view towards our ideal state in three years.

■ Kojima

If we just look at reality and add up the numbers, it will be difficult to effectively manage the targets we set in the coming era of drastic changes in the business environment. President Aoki often says, “To survive in the coming era, we need to take on the challenge of adapting to paradigm shifts.” As we move into a world of high interest rates and rising inflation, it is inevitable that costs, especially labor costs, will rise at a faster pace. In times like these, it is especially important to adopt a backcasting approach, innovate, and take on bold challenges, such as new M&A.

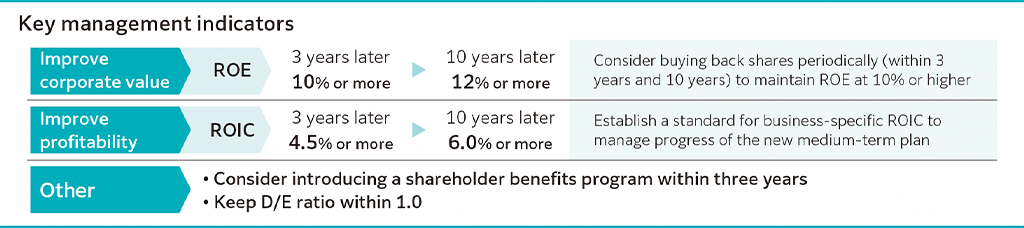

Improve ROE, introduce and fully use ROIC as an indicator

■ Kojima

Improving ROE is an important theme, and has been an issue since the previous medium-term plan. If shareholders’ equity continues to increase but profits do not, ROE will decline. Given that we have set a high ROE target, it is important that we actively pursue profit growth and have in-depth discussions about how to achieve it. However, awareness of the need to improve ROE has not yet fully permeated the Company, and further efforts are needed to raise awareness. Specifically, we need to have in-depth discussions about how to increase the added value of our businesses in order to increase net sales and profit margins. To improve the investment efficiency of each business, we must introduce ROIC into our management and ensure that it is fully implemented. I think trial and error is unavoidable when creating a system for how to allocate interest-bearing debt to each business. When reviewing the business portfolio, it is essential to use business-specific ROIC to “visualize” investment efficiency.

President Aoki has asked us to speed up our transformation, and I feel that it is important to utilize business-specific ROIC in order to quickly assess the results of strategic investments.

■ Ueda

I think it is important to get serious about changing our corporate culture at this point. At present, the focus is on accumulating absolute amounts of net sales and profits, and the groundwork to consider asset and capital efficiency has not been completed. From now on, we need to discuss this not just from the perspective of profit and loss, but also from the perspectives of ROE and ROIC, and have this instilled in our business operations.

For example, currently the ROIC of the Machinery Business is higher than the Food Business. To avoid criticism of the Food Business based solely on that, we should start by developing a calculation method that takes into account the characteristics of each business segment.

Cash allocation (investment plan)

■ Ueda

M&A requires investment decisions to be made on a case-by-case basis. However, in terms of capital investment, we believe that aquaculture businesses, such as investment in Fish Farm Mirai LLC, are important. To reduce the burden on the environment, we will proactively invest in biodegradable plastics and the creation of algae beds. In the Food Business, we continue to invest in our scallop plant in Mombetsu. We are also focusing on system investments as a Group-wide initiative, as part of our efforts to take on the challenge of creating total optimization.

■ Kojima

In M&A, we would like to focus on the Machinery and Food businesses. The expansion of the Machinery Business is driven by the labor shortage problems faced by our customers. One of the keys to offsetting this is the introduction of machinery. In order to solve this urgent issue, we need to adopt the perspective of “buying time.” The same is true for the Food Business. Even if we want to focus on processing, it takes time to develop the human resources. In such a situation, M&A should be an effective tool.

Creating new value for the future

■ Ueda

The Group’s new Purpose sets out our desire to “be a company that creates new value for the future.” There are 18 consolidated subsidiaries under our umbrella, each with their own origins and culture. If these diverse cultures can be successfully blended, new value may be created.

■ Kojima

From a financial perspective, it is important for us to increase sustainable businesses and continue to create value for the future. In particular, the key is how much we can increase future cash flows. These efforts must target increasing the corporate value of the entire Group. To do this, we need to be aware of ROE and ROIC. This means raising awareness in each business division with an eye on the Group’s Purpose. As the head of the administrative section, I intend to focus intently on this.