Increase corporate value by growing cash flow and improving capital efficiency

Yoshitomo Yageta

Senior Managing Director,

Assistant to President, in charge of overall management

We will expand our existing business and create new businesses to achieve stable growth in operating cash flow, proceeding to increase investments for further business expansion while pursuing the increase of shareholder value.

Capital strategy

My main mission as Senior Managing Director is to continuously increase Nichimo’s corporate value.

Having chosen to list on Tokyo Stock Exchange’s Prime Market, satisfying the criteria to secure our continued listing is an urgent issue for Nichimo.

We are currently promoting several measures to resolve this issue, and we are making steady progress with our plan.

1) Increasing our tradable market capitalization

Increasing our corporate value and obtaining its appropriate evaluation in the capital markets to increase our tradable market capitalization, thereby clearing the level of 10.0 billion yen needed to maintain a listing on the TSE Prime Market is a significant challenge at this stage.

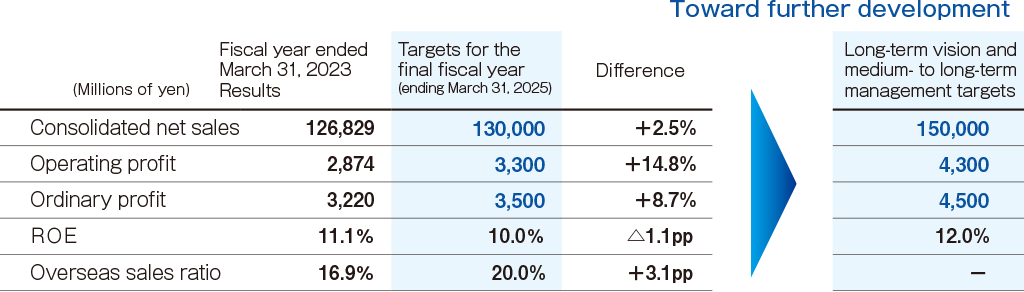

In order to obtain an appropriate evaluation of its corporate value, Nichimo must communicate to the capital markets its ability to sustainably increase profits. A major premise here is steady progress of our three-year Fiscal 2023 Medium-Term Management Plan “Toward the next stage” (the current medium-term management plan), which we are working on right now. For the fiscal year ended March 31, 2023, Nichimo’s overall net sales grew year on year, led by the Food and Marine Businesses, despite a decrease in sales in the Machinery Business after a round of large projects was completed. Meanwhile, operating profit declined year on year, mainly due to the impact of the aforementioned completion of a round of large projects in the Machinery Business, despite an increase in sales of aquaculture feed in the Marine Business. This resulted from factors such as an increase in fish meal production at the new plant of Yamaichi Suisan Co.,Ltd., where the Company had made a significant capital investment. We will continue to focus on pioneering new businesses to promote the stable expansion of business, and on strengthening business collaboration within the Group. Furthermore, we will strive to develop land-based aquaculture and further strengthen the overseas business.

Our performance has been stable over the past few years, and we have issued share acquisition rights (with exercise price amendment clause) through third-party allotment and concluded a facility agreement. These are based on our judgement that in order to make business investments for the future, we need to bolster the health of our finances by increasing equity through capital procurement with the progressive execution of these rights. At the same time, we also intend to increase the liquidity of our shares by increasing the number of issued shares, while increasing corporate value and ensuring an appropriate share price. To improve our capital efficiency, we are striving to achieve the optimal capital composition with an awareness of ROA and ROIC, based on improvement of our financial position, and we are working to increase the sophistication of our cash flow management.

2) Improvement of operating cash flow

Thinking about the cost of capital, naturally we need to produce a higher level of profit, and we also need to improve operating cash flow in order to strengthen our financial position.

With regard to the assumed characteristics of cash flow based on the nature of the Company’s business, in the Food Business, the season for catching marine products is concentrated from early spring to early autumn, so we make our purchases first.

Subsequently, we sell the marine products we have purchased through to the end of the year, thereby recovering our funds. On the other hand, in the three businesses of Marine, Machinery, and Materials, the period between purchase to fund recovery is comparatively shorter, and we are conscious of the balance by which these funds can cover for the long period for recovery of funds in the Food Business.

Based on these characteristics, we are working to improve operating cash flow by applying cash flow management, including efforts to shorten the recovery period and reduce inventories in each business.

In the fiscal year ending March 31, 2024, we face a number of negative impacts on operating cash flow, such as inflation caused by monetary easing and high price for marine resources. However, by applying the measures mentioned above, we intend to further increase the level of our cash flow management.

3) Proactive approach to investor relations activities

We are stepping up our investor relations (IR) activities to help ensure that Nichimo’s corporate value is evaluated appropriately by the capital markets (appropriate share price). To increase recognition of Nichimo’s businesses, we hold financial results presentations for institutional investors twice a year. In the fiscal year ended March 31, 2023, we started holding presentations for individual investors. We have also renewed our company website to clearly communicate the Company’s appeal and information, and ensure recognition of the Company by a wide range of investors.

Moreover, to upgrade our information disclosure, we have created and implemented a policy of actively and fairly disclosing corporate information based on our IR policy.

Progress on investment plan and sources of funds

Our current three-year medium-term management plan calls for capital investments totaling 10.0 billion yen. Our aims are to develop land-based aquaculture, practical application of biomass fishing nets, building a system for the stable supply of marine products, and M&As.

In the development of land-based aquaculture business, we launched the largest land-based salmon aquaculture farm in the Kyushu Region on a site owned by Kyushu Electric Power Company, Incorporated. Fish Farm Mirai LLC, our newly established company, operates the farm . At the time when operations started, the farm had a production capacity of approximately 300 tonnes per year, and we are gradually expanding the capacity, looking at securing capacity of approximately 3,000 tonnes per year. In practical application of biomass fishing nets, we are carrying out research and development of nets made using corn-derived polylactic acid, or PLA. We expect to launch a commercial product by March 2025. In our efforts to build a system for the stable supply of marine products, we completed the construction and started operation of a new plant at Yamaichi Suisan Co.,Ltd. in June 2022. In addition, to strengthen the management and manufacturing system of our Mombetsu Plant and Hokkaido Marine Service Co.,Ltd., which handle crab and scallops, in April 2023 we started operating these as Okhotsk Nichimo Co.,Ltd.

With regard to the long-term funds related to investments and loans, we are working to ensure liquidity while comprehensively taking into account market interest rate trends and the repayment schedules for existing long-term borrowings, etc. based on our capital investment and business investment plans. Our basic policy regarding working capital is to ensure liquidity of funds needed for business and stable sources of funds. We have secured liquidity of the necessary working capital by using bank loans and establishing commitment lines.

Looking ahead to the next medium-term management plan

In our initiatives under the medium-term management plan, by promoting the measures mentioned above, we aim to achieve our targets for the final fiscal year of the plan early: net sales of 130.0 billion yen and ordinary profit of 3.5 billion yen. We are also considering actions for our next stage. The long-term vision and medium- to long-term management targets that we have already disclosed include net sales of 150.0 billion yen and ordinary profit of 4.5 billion yen. These numerical targets will be difficult to achieve on the basis of expanding our existing businesses alone.

In addition to getting our current new businesses firmly established, it will also be necessary to incorporate new businesses through M&As and so forth. Securing operating cash flow during the period of the current medium-term management plan is also an essential step for achieving these targets.

As the director responsible for this area, I will redouble my efforts to increase corporate value and shareholder value by further increasing cash flow and capital efficiency.

Medium-term management plan: KPIs (fiscal year ended March 31, 2023 to fiscal year ending March 31, 2025)